-

Email Us

- Top Reports

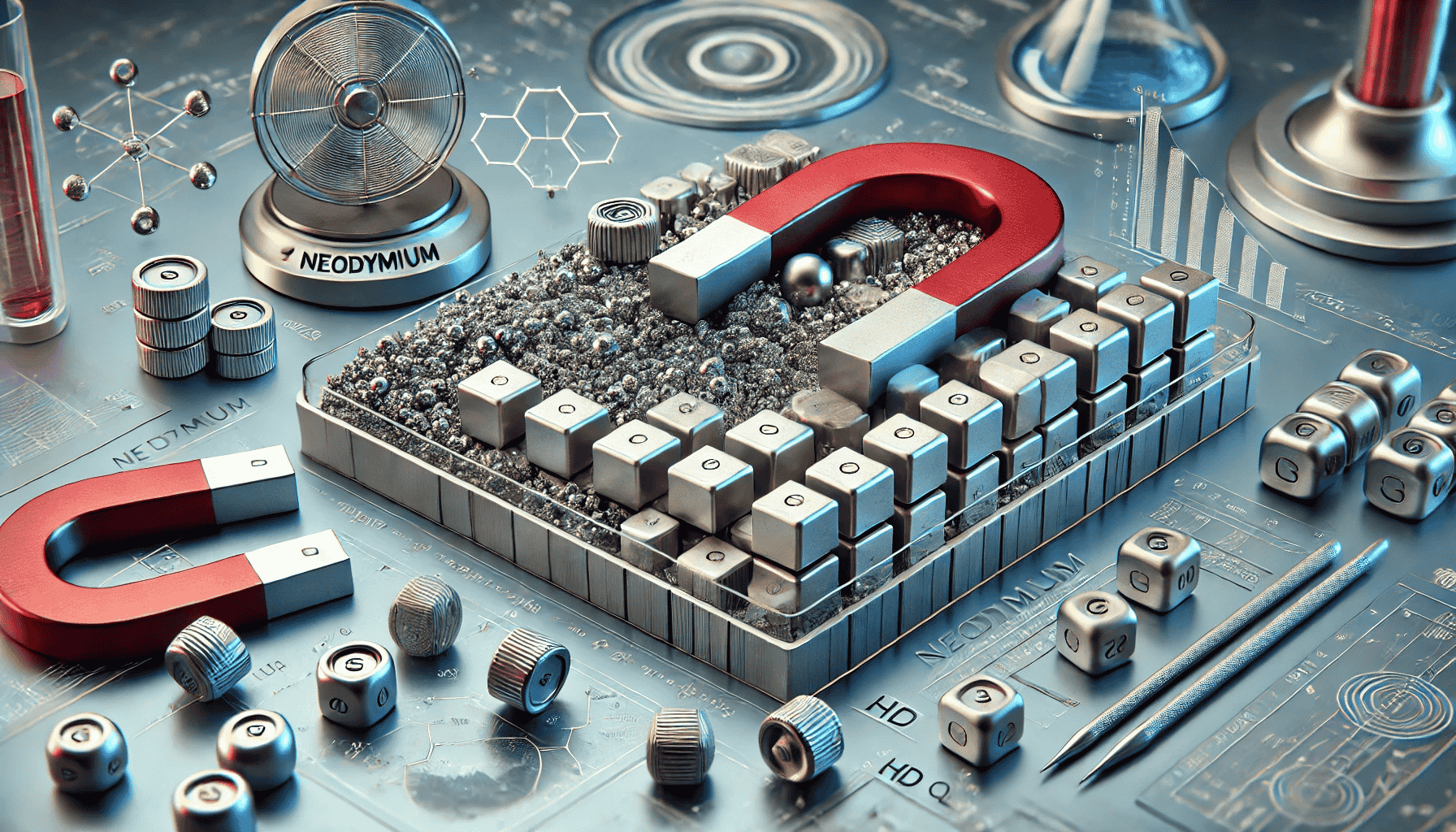

The Ultimate Guide to Investing in Neodymium Stocks: Trends, Insights, and Future Opportunities

Posted On 12 November, 2024

Neodymium, a rare earth metal with remarkable magnetic properties, is essential for various high-tech industries including electronics and clean energy. Its unique characteristics make it a key component in producing high-performance magnets, which are crucial for electric vehicles, wind turbines, and advanced electronics. As the global push for green energy and sustainable technologies gains momentum, neodymium's demand and relevance continue to grow. For investors seeking to tap into the growth potential of critical minerals, neodymium stocks present significant opportunities. This guide explores the top trends impacting neodymium stocks, the industry dynamics driving demand, effective investment strategies, and the future outlook for this critical metal.

One of the main drivers of neodymium demand is the renewable energy and electric vehicle sectors. As the world moves toward renewable energy solutions, the need for neodymium, particularly in high-performance magnets, continues to expand. These magnets are essential in producing wind turbines and electric vehicles where they are used in electric motors to enable efficient energy conversion. The global transition to clean energy has put substantial pressure on neodymium supply, creating opportunities for investors as companies strive to meet this growing demand. The electric vehicle market, especially in regions like Europe and Asia, is set to further bolster neodymium demand, positioning it as a vital resource for green energy applications.

Now Get Sample PDF Report on : Neodymium (Nd) Market Growth Opportunities 2024-2031

https://www.statsndata.org/download-sample.php?id=186112

China plays a dominant role in neodymium production and holds a substantial share of the global rare earth supply chain. China produces over 80 percent of the world’s neodymium, giving it considerable leverage over pricing and supply, which in turn affects global markets and investor sentiment. For investors in neodymium stocks, understanding China’s influence is essential, as any political or regulatory shifts within China can directly impact global supply and prices. As a response to China’s dominance, countries such as the United States, Japan, and Australia are investing in local neodymium production and processing facilities to create a more balanced market and provide alternative opportunities for investors who are cautious about the risks of relying on a single dominant player.

In line with efforts to diversify neodymium sources, governments and private investors are increasing funding for rare earth mining projects outside China. Nations like Australia, Canada, and the United States are scaling up rare earth mining operations to create alternative sources for neodymium. Companies such as Lynas Rare Earths in Australia and MP Materials in the United States are among the few non-Chinese entities making progress in this area. As new mining projects come online, they will likely impact neodymium supply and pricing, providing investors with additional options for investing in neodymium stocks beyond China-dominated supply chains.

As the mining of rare earth elements is costly and environmentally taxing, recycling neodymium from existing products is becoming a viable solution. Neodymium can be extracted from old electronics, electric vehicle motors, and wind turbines, reducing the need for new mining operations. Companies and research institutions are focusing on advanced recycling techniques to recover neodymium efficiently, potentially transforming it into a circular resource. For investors, this shift towards recycling neodymium represents an opportunity for a more stable supply, lower production costs, and enhanced sustainability in the neodymium market, making it an attractive option for long-term investment opportunities.

Sustainability initiatives and Environmental, Social, and Governance (ESG) investing have gained prominence, with more investors favoring companies that prioritize sustainable practices. Neodymium mining has a significant environmental impact, leading companies to adopt eco-friendly mining and processing methods to attract ESG-focused investors. Firms committed to sustainable practices may see increased investment interest, especially as demand grows for ethically sourced and environmentally responsible resources. For investors, neodymium stocks of companies that embrace ESG principles offer the chance to support sustainable development while also capitalizing on the growth potential of the neodymium market.

Neodymium is also a key component in various electronic devices, from headphones to smartphones, due to its ability to create powerful yet lightweight magnets. As consumer electronics continue to expand and evolve, the demand for neodymium is projected to grow further. The rapid expansion of the electronics market, especially in emerging economies, will drive additional demand for neodymium, making it a critical element in the consumer technology space. For investors, the booming electronics sector represents an important growth opportunity in neodymium stocks, as companies work to meet the rising consumer demand for high-performance devices.

Global trade tensions, particularly between the United States and China, have brought rare earth elements, including neodymium, into the spotlight. Trade restrictions, tariffs, and export controls can impact neodymium availability and prices, as seen during the U.S.-China trade disputes. Investors in neodymium stocks should pay close attention to international trade policies and their potential effects on rare earth supply chains. Geopolitical developments can create volatility in the neodymium market, presenting both risks and opportunities for investors. A diversified portfolio, including stocks from different regions, can help mitigate some of these geopolitical risks.

Research into alternatives to neodymium-based magnets is underway, particularly in sectors heavily reliant on rare earth elements. Although viable substitutes are not yet commercially viable at scale, breakthroughs in alternative materials or synthetic substitutes could eventually influence neodymium demand. For investors, keeping an eye on advancements in alternative technologies is crucial, as significant innovations could impact neodymium stocks in the long term. Currently, however, neodymium remains the preferred material for high-strength magnets, and the lack of a cost-effective substitute continues to make it indispensable for several high-growth industries.

The high costs and environmental impact associated with rare earth mining have prompted companies to develop new technologies to improve the efficiency of extraction and processing. Advancements such as solvent extraction and ion-exchange processes are making mining more sustainable and economically feasible. For investors, companies that invest in these new technologies present potential growth opportunities as they stand to benefit from cost savings and increased production capacity, strengthening their competitive position in the global neodymium market.

Demand for neodymium-based magnets extends to the defense and aerospace sectors, where they are used in high-tech equipment such as missile systems and drones. As global defense budgets increase, the demand for high-performance materials like neodymium also grows. Countries are keen to secure a stable neodymium supply chain for national security reasons, which further drives demand in these sectors. For investors, companies supplying neodymium to defense and aerospace industries offer a relatively stable demand base, even during economic downturns, making them attractive investments for a diversified portfolio.

For those interested in neodymium stocks, certain strategies and insights can help optimize returns. Diversifying across regions and companies is critical given China’s dominance in production. By investing in companies outside China, investors can spread their risk and reduce dependency on a single source. Companies that adhere to ESG principles and sustainable practices may appeal to a growing pool of investors focused on ethical investing, potentially providing long-term value. Staying informed about geopolitical developments and trade policies is also important, as these factors can directly influence the neodymium market. Monitoring emerging technologies and alternative materials can further help investors anticipate changes in neodymium demand, allowing them to adjust their portfolios accordingly.

For investors new to this market, a few questions often arise. One common question is why neodymium is so crucial for the green energy industry. Neodymium magnets are essential for wind turbines and electric vehicles, where their efficiency and performance significantly benefit green energy solutions. Another question is why China has such a dominant position in neodymium production. China has invested heavily in rare earth mining infrastructure, allowing it to produce these elements more cost-effectively than other countries. Some investors also wonder about the environmental concerns associated with neodymium mining. Mining and processing neodymium require significant resources and can impact water sources, but companies are increasingly adopting sustainable practices to reduce these effects. Another frequently asked question is how investors can mitigate risks when investing in neodymium stocks. Diversifying investments across multiple regions and monitoring geopolitical developments are two key ways to reduce risk exposure. Finally, many investors ask if the demand for neodymium is expected to grow. Given the expansion of renewable energy, electronics, and defense applications, demand for neodymium is projected to continue increasing, supporting its long-term value as a critical resource.

Neodymium stocks offer an exciting opportunity in today’s rapidly evolving markets. With applications spanning multiple high-growth sectors, including renewable energy, advanced electronics, and defense, neodymium is poised to remain relevant in modern technology and infrastructure. As countries work to secure stable supplies of critical minerals and companies commit to more sustainable practices, neodymium’s importance in future technologies is likely to grow. By understanding the trends driving neodymium demand and staying informed about geopolitical and technological shifts, investors can unlock the growth potential of neodymium stocks, positioning themselves within one of the most promising sectors for the future.

Recent Blogs

Global Fitness Apps Market: Pioneering the Future of Health and Wellness Through Technology

Global Doll Ningyo Market: Reviving Heritage and Craftsmanship Through Modern Innovation

Global Basketball Training Equipment Market: Shaping the Future of Athletic Excellence with Adv

Global Women’s Sportswear Market: Driving Innovation and Sustainability in Activewear

Top 10 Trends in Chocolate Consumption by State: Insights, Impacts, and Strategies

Top 10 Trends in Mega Data Centers Driving the Future of Technology

Top 10 Trends in Waste-to-Energy Companies in the USA

The Ultimate Guide to High-Flow Nasal Cannula Brands: Trends, Insights, and Best Practices